Let’s talk about something that’s been on everyone's mind lately—45.6 billion won to USD. Whether you're an investor, a traveler, or just someone curious about global currency exchanges, this topic has got some serious weight behind it. The world of currency conversion isn’t just numbers; it’s a reflection of economic health, trade relations, and even geopolitical dynamics. So buckle up, because we’re about to break it down in a way that’s both easy to understand and packed with insights.

Now, why does 45.6 billion won to USD matter? Well, imagine you’re a business owner looking to expand into South Korea or an investor analyzing market trends. Understanding how much 45.6 billion won translates to in USD can make or break your decisions. It’s not just about the math; it’s about the story behind the numbers. And trust me, this story is worth hearing.

As we dive deeper into this topic, we’ll explore everything from the current exchange rates to historical trends, economic factors, and even how global events shape these conversions. By the end of this article, you’ll not only know how much 45.6 billion won is in USD but also why it matters in the grand scheme of things. Let’s get started, shall we?

Read also:Mmsvideo

Understanding Currency Conversion: The Basics

Before we jump into the nitty-gritty of 45.6 billion won to USD, let’s first tackle the basics of currency conversion. Think of it like a recipe—there are ingredients, measurements, and steps involved. The exchange rate is your main ingredient, and it determines how much one currency is worth in another. For instance, if the exchange rate is 1,300 won to 1 USD, then 45.6 billion won would roughly translate to 35 million USD. Easy, right? Well, not always.

Exchange rates are influenced by a ton of factors, including inflation, interest rates, and even political stability. It’s like trying to bake a cake while someone keeps messing with the oven temperature. Things can get complicated pretty quickly.

Why Does Currency Conversion Matter?

Currency conversion isn’t just for travelers trying to figure out how much their coffee costs abroad. It’s a crucial aspect of global trade, investment, and even personal finance. For businesses, understanding exchange rates can mean the difference between profit and loss. For individuals, it can impact everything from buying foreign goods to planning vacations.

Let’s take a step back and think about why someone might care about converting 45.6 billion won to USD. Maybe they’re a South Korean tech company looking to expand into the US market. Or perhaps they’re a US-based investor eyeing opportunities in South Korea. Whatever the reason, the conversion rate plays a pivotal role in their decision-making process.

The Current Exchange Rate: Where Are We Now?

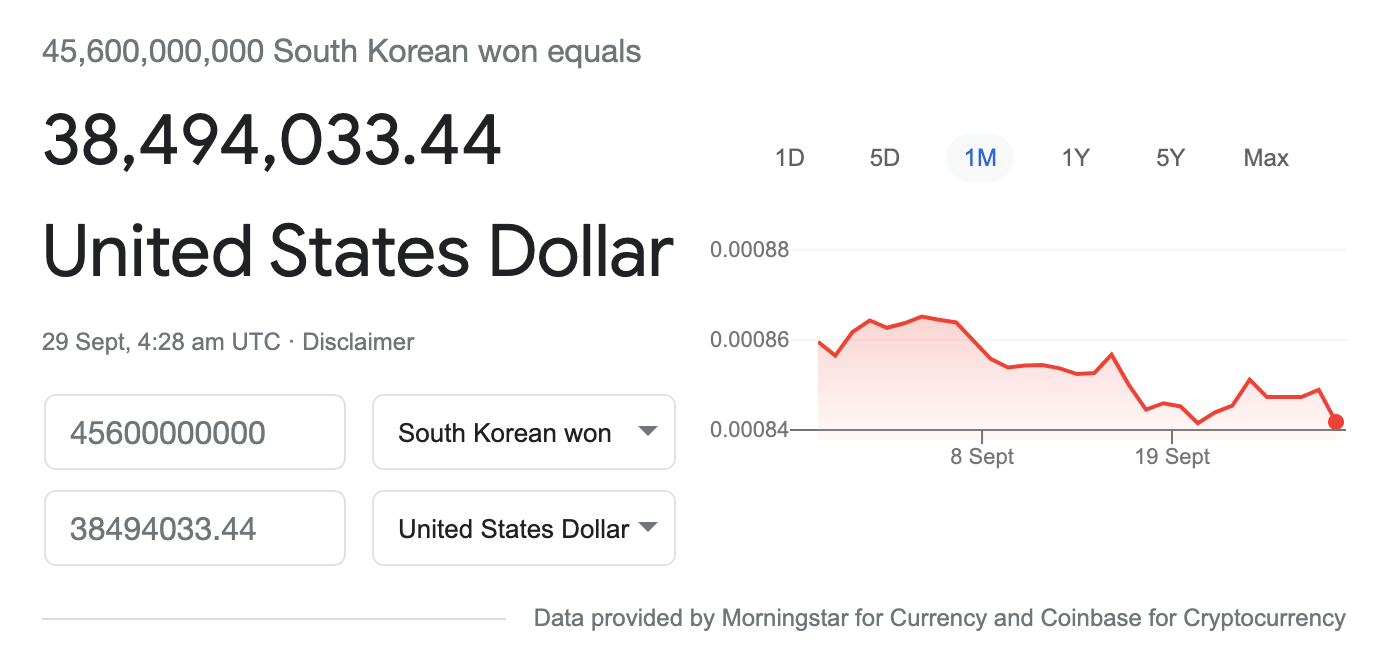

Alright, let’s cut to the chase. As of the latest data, the exchange rate for South Korean won (KRW) to US dollar (USD) hovers around 1,300 won to 1 USD. This means that 45.6 billion won is roughly equivalent to 35 million USD. But hold up—this number isn’t set in stone. Exchange rates fluctuate constantly, influenced by a variety of factors.

One of the biggest factors affecting exchange rates is inflation. If South Korea experiences high inflation, the value of the won might decrease relative to the USD. On the flip side, if the US economy is struggling, the value of the USD might drop. It’s like a seesaw—always moving, always changing.

Read also:Xxx Hot

What Drives Exchange Rate Fluctuations?

So, what makes exchange rates go up and down? Here are a few key factors:

- Inflation Rates: Higher inflation usually leads to a weaker currency.

- Interest Rates: Countries with higher interest rates often attract more investors, strengthening their currency.

- Political Stability: Uncertainty can lead to a weaker currency as investors lose confidence.

- Economic Performance: Strong economies tend to have stronger currencies.

For example, if South Korea’s economy is booming while the US economy is struggling, the won might strengthen against the USD. Conversely, if the US economy is doing well while South Korea faces challenges, the USD might gain value.

Historical Perspective: How Have Rates Changed Over Time?

To truly understand the significance of 45.6 billion won to USD, we need to look at the historical context. Exchange rates haven’t always been where they are today. In fact, they’ve gone through some pretty wild fluctuations over the years.

Back in the early 2000s, the exchange rate was closer to 1,200 won to 1 USD. Fast forward to the 2010s, and it hovered around 1,100 won to 1 USD. But in recent years, it’s climbed back up to around 1,300 won to 1 USD. What’s causing these changes? A mix of economic policies, global events, and market dynamics.

Key Historical Events That Shaped Exchange Rates

Here are a few key events that have influenced the KRW to USD exchange rate over the years:

- 2008 Financial Crisis: The global financial crisis led to a significant drop in the value of the won.

- 2015 China Slowdown: When China’s economy slowed, it had a ripple effect on South Korea, weakening the won.

- 2020 Pandemic: The COVID-19 pandemic caused massive fluctuations in exchange rates worldwide.

These events serve as a reminder that exchange rates are not static. They’re constantly evolving, shaped by both internal and external forces.

45.6 Billion Won to USD: The Math Behind It

Now, let’s do the math. If the current exchange rate is 1,300 won to 1 USD, then 45.6 billion won would be approximately 35 million USD. But here’s the thing—exchange rates aren’t always straightforward. There are fees, spreads, and other factors that can affect the final amount.

For instance, if you’re converting through a bank or currency exchange service, you might not get the exact rate you see online. They often charge a fee or offer a less favorable rate to make a profit. So while the theoretical conversion is 35 million USD, the actual amount you receive might be slightly lower.

Factors That Affect the Final Conversion Amount

Here are a few factors that can impact the final amount:

- Transaction Fees: Banks and currency exchange services often charge fees for conversions.

- Spread: The difference between the buying and selling rates can also eat into your final amount.

- Market Volatility: Fluctuations in the exchange rate can occur even during the transaction process.

It’s always a good idea to shop around and compare rates before making a large conversion. A few percentage points can make a big difference when you’re dealing with billions of won.

Economic Implications: What Does This Mean for Businesses and Investors?

Now that we’ve covered the basics, let’s talk about the bigger picture. What does 45.6 billion won to USD mean for businesses and investors? For starters, it can impact everything from pricing strategies to profit margins. If a South Korean company is exporting goods to the US, a stronger won could mean higher costs for US consumers. Conversely, a weaker won could make South Korean goods more competitive in the global market.

Investors also need to keep an eye on exchange rates. If they’re investing in South Korean companies, a strong won could mean lower returns when converted back to USD. On the other hand, a weak won could make South Korean investments more attractive.

Case Studies: Real-World Examples

Let’s look at a couple of real-world examples to illustrate the impact of exchange rates:

- Samsung Electronics: As one of South Korea’s largest companies, Samsung is heavily affected by exchange rate fluctuations. A stronger won can reduce their profit margins, while a weaker won can boost their competitiveness.

- Apple in South Korea: When the won strengthens against the USD, Apple’s products become more expensive for South Korean consumers, potentially impacting sales.

These examples highlight just how interconnected the global economy is and how exchange rates play a crucial role in business decisions.

Global Trends: How Does This Fit Into the Bigger Picture?

Finally, let’s zoom out and look at the bigger picture. How does 45.6 billion won to USD fit into global economic trends? In recent years, we’ve seen a shift towards digital currencies and decentralized finance. While traditional currencies like the won and USD still dominate, the rise of cryptocurrencies and blockchain technology is changing the game.

Additionally, geopolitical tensions and trade policies are increasingly influencing exchange rates. Tariffs, sanctions, and trade agreements can all have a significant impact on how currencies perform against each other.

Looking Ahead: What’s Next for Currency Exchange?

As we move into the future, it’s clear that currency exchange will continue to evolve. Advances in technology, changes in global trade dynamics, and shifts in economic policies will all play a role in shaping the landscape. For now, understanding the basics of currency conversion and staying informed about global trends is key to making smart financial decisions.

Conclusion: Wrapping It All Up

So there you have it—a deep dive into 45.6 billion won to USD and everything it entails. From the basics of currency conversion to the economic implications and global trends, we’ve covered a lot of ground. Whether you’re a business owner, an investor, or just someone curious about global finance, understanding exchange rates is crucial in today’s interconnected world.

Here’s a quick recap of what we’ve learned:

- Exchange rates are influenced by a variety of factors, including inflation, interest rates, and political stability.

- Historically, the KRW to USD exchange rate has fluctuated significantly, shaped by global events and economic policies.

- For businesses and investors, exchange rates play a crucial role in decision-making, impacting everything from pricing strategies to profit margins.

Now, it’s your turn to take action. Whether that means leaving a comment, sharing this article, or diving deeper into the world of currency exchange, I encourage you to engage and explore. After all, knowledge is power—and in the world of finance, it can make all the difference.

Daftar Isi

- 45.6 Billion Won to USD: A Deep Dive Into the Conversion and Its Impact

- Understanding Currency Conversion: The Basics

- Why Does Currency Conversion Matter?

- The Current Exchange Rate: Where Are We Now?

- What Drives Exchange Rate Fluctuations?

- Historical Perspective: How Have Rates Changed Over Time?

- Key Historical Events That Shaped Exchange Rates

- 45.6 Billion Won to USD: The Math Behind It

- Factors That Affect the Final Conversion Amount

- Economic Implications: What Does This Mean for Businesses and Investors?

- Case Studies: Real-World Examples

- Global Trends: How Does This Fit Into the Bigger Picture?

- Looking Ahead: What’s Next for Currency Exchange?

- Conclusion: Wrapping It All Up