Have you ever heard someone say "out of pocket" and wondered what exactly they meant? Well, buckle up, because we're about to break it down for you in a way that’s easy to understand and packed with useful info. Whether you’re diving into finance, personal expenses, or just trying to make sense of common slang, understanding "out of pocket" is key. Let’s get started!

In today’s world, where money talks and budgets matter, knowing the ins and outs of financial terms like "out of pocket" can save you a ton of trouble. Whether you're dealing with medical bills, business expenses, or even casual conversations, this phrase pops up more often than you'd think. So, what exactly does "out of pocket" mean? Stick around, and we’ll spill the tea.

This article isn’t just about definitions; it’s about giving you the tools to navigate financial waters like a pro. We’ll cover everything from the basic meaning to advanced applications, all while keeping things simple and relatable. Think of this as your go-to guide for mastering "out of pocket" in any context. Ready? Let’s dive in!

Read also:Gloria Bell Malone

What Does Out of Pocket Mean? The Basics

Let’s start with the basics. "Out of pocket" refers to the money you personally spend on something, often in situations where costs aren’t fully covered by insurance, reimbursements, or other parties. For example, if you have a medical bill and your insurance only covers part of it, the rest that you pay is considered "out of pocket." Simple, right?

But here’s the twist: the term isn’t limited to just medical expenses. You’ll hear it tossed around in business, personal finance, and even casual conversations. It’s like a financial Swiss Army knife—versatile and always handy.

Out of Pocket in Everyday Life

- In healthcare: Think copayments, deductibles, and coinsurance.

- In business: Employee expenses not covered by the company.

- In personal finance: Any money you spend directly from your pocket.

Understanding this concept can help you plan better, budget smarter, and avoid nasty surprises. Now that we’ve got the basics down, let’s explore some common scenarios where "out of pocket" plays a starring role.

Out of Pocket Expenses in Healthcare

Healthcare is one of the biggest areas where "out of pocket" expenses come into play. From doctor visits to prescription medications, the costs can pile up fast. But don’t panic—let’s break it down.

When you have health insurance, there are usually three main components that affect your "out of pocket" expenses: deductibles, copayments, and coinsurance. Here’s a quick rundown:

- Deductible: The amount you pay before your insurance kicks in.

- Copayment: A fixed amount you pay for certain services, like doctor visits.

- Coinsurance: A percentage of the cost you pay after your deductible is met.

Knowing these terms can help you make informed decisions about your healthcare and manage your expenses more effectively. Plus, most insurance plans have an "out of pocket maximum," which is the most you’ll have to pay in a year. After that, your insurance covers everything.

Read also:Ultimate Guide To Mkvmoviespoint 1 Everything You Need To Know

Out of Pocket Meaning in Business

Switching gears to the business world, "out of pocket" takes on a slightly different but equally important role. In this context, it often refers to expenses that employees or contractors pay upfront for work-related tasks.

For example, if an employee travels for a business meeting and pays for their own hotel and meals, those costs are considered "out of pocket." The good news is that many companies reimburse these expenses, but it’s always good to keep track of them.

Tracking Business Expenses

Here are a few tips for managing "out of pocket" expenses in a business setting:

- Keep detailed receipts for all expenses.

- Use expense-tracking apps to stay organized.

- Submit reimbursement requests promptly.

By staying on top of these expenses, you can ensure that you’re not left footing the bill for work-related costs.

Out of Pocket Meaning in Personal Finance

When it comes to personal finance, "out of pocket" is all about the money you spend directly from your own funds. This could be anything from groceries to entertainment, but the key is that it’s money you’re personally responsible for.

Managing "out of pocket" expenses in personal finance is all about budgeting. By setting limits and tracking your spending, you can avoid overspending and stay on top of your financial goals.

Tips for Managing Personal Expenses

- Create a monthly budget and stick to it.

- Use cash or prepaid cards to control spending.

- Track your expenses using apps or spreadsheets.

Remember, the goal is to be aware of where your money is going and make adjustments as needed. It’s all about balance and discipline.

Out of Pocket in Casual Conversations

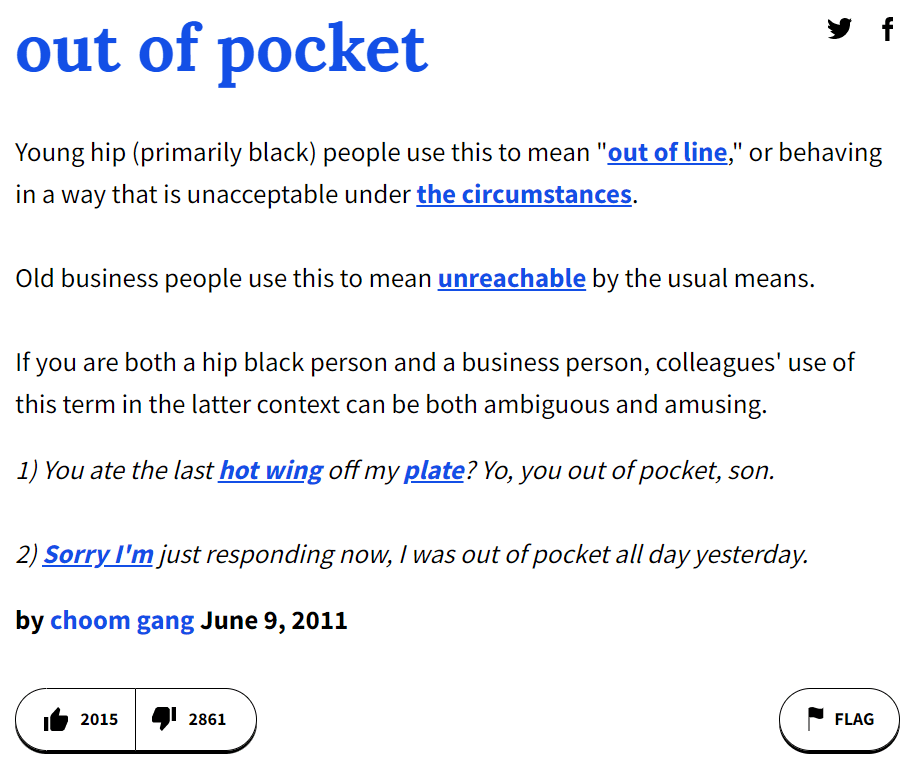

Now, let’s talk about the more informal side of "out of pocket." In casual conversations, the phrase can take on a slightly different meaning. Sometimes, it’s used to describe someone who’s acting out of character or being unreasonable.

For example, if a friend says, "She went out of pocket on me," they might mean that the person acted unexpectedly or lost their cool. It’s a way of expressing surprise or frustration in a lighthearted manner.

Common Slang Uses

- Describing unexpected behavior: "He went out of pocket when he missed the meeting."

- Expressing disbelief: "Did she really say that? She must be out of pocket!"

While this usage might not be as formal as the financial context, it’s still a fun and relatable way to use the phrase.

Out of Pocket Maximum: What It Means and Why It Matters

One of the most important concepts in understanding "out of pocket" expenses is the "out of pocket maximum." This is the most you’ll have to pay in a year for covered services under your insurance plan. Once you hit this limit, your insurance covers 100% of the costs.

Why does this matter? Because knowing your "out of pocket maximum" can help you plan for the worst-case scenario and avoid financial stress. It’s like having a safety net for your wallet.

How to Find Your Out of Pocket Maximum

- Check your insurance policy documents.

- Contact your insurance provider for clarification.

- Use online tools or apps to track your progress.

By staying informed, you can make smarter decisions about your healthcare and other expenses.

Common Misconceptions About Out of Pocket

Let’s clear up a few common misconceptions about "out of pocket" expenses. First, it’s not just about healthcare. While medical bills are a big part of it, the term applies to many other areas of life.

Second, "out of pocket" doesn’t always mean you’re losing money. In some cases, you might be reimbursed later, so it’s important to keep track of your expenses.

Clearing the Air

- "Out of pocket" isn’t just for medical bills.

- Reimbursements can offset initial costs.

- Tracking expenses is key to managing finances.

By understanding these nuances, you can avoid common pitfalls and make better financial decisions.

Out of Pocket in the Digital Age

In today’s digital world, managing "out of pocket" expenses has never been easier. With the rise of budgeting apps, expense trackers, and online banking, you can keep tabs on your spending from the palm of your hand.

From apps like Mint and YNAB to built-in features in your bank’s mobile app, there are plenty of tools to help you stay on top of your finances. Plus, many of these apps offer features like expense categorization, goal setting, and even alerts for overspending.

Top Tools for Managing Expenses

- Mint: A free app for budgeting and expense tracking.

- YNAB: A powerful tool for zero-based budgeting.

- Personal Capital: Great for tracking investments and expenses.

By leveraging these tools, you can take control of your finances and make smarter decisions about your "out of pocket" expenses.

Final Thoughts: Why Understanding Out of Pocket Matters

So, there you have it—a comprehensive guide to understanding "out of pocket" expenses. Whether you’re dealing with healthcare, business, personal finance, or casual conversations, knowing what "out of pocket" means can make a big difference in how you manage your money.

Here’s a quick recap of what we’ve covered:

- Out of pocket refers to money you personally spend on something.

- It plays a big role in healthcare, business, and personal finance.

- Tracking and managing these expenses is key to financial success.

Now that you’re armed with this knowledge, it’s time to take action. Start tracking your expenses, set financial goals, and don’t be afraid to ask questions. Your wallet will thank you!

Got any questions or tips of your own? Drop them in the comments below, and don’t forget to share this article with your friends. Knowledge is power, and when it comes to finances, every little bit helps. Stay sharp, and keep those pockets full!

Table of Contents

- What Does Out of Pocket Mean? The Basics

- Out of Pocket Expenses in Healthcare

- Out of Pocket Meaning in Business

- Out of Pocket Meaning in Personal Finance

- Out of Pocket in Casual Conversations

- Out of Pocket Maximum: What It Means and Why It Matters

- Common Misconceptions About Out of Pocket

- Out of Pocket in the Digital Age

- Final Thoughts: Why Understanding Out of Pocket Matters